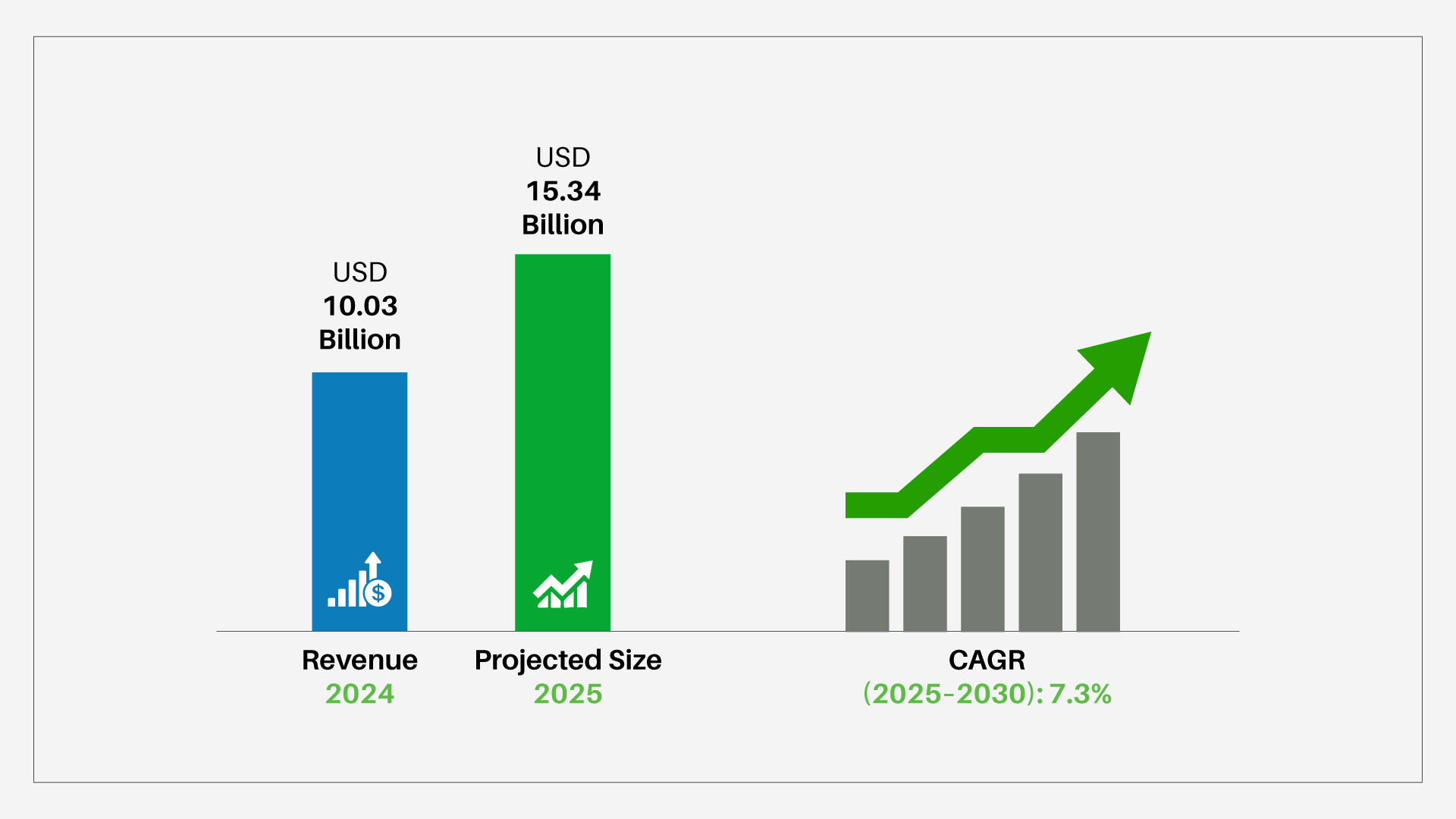

The U.S. LED lighting market is undergoing a significant transformation, supported by federal energy mandates, rising sustainability goals, and smart infrastructure rollouts across states. As per recent industry projections, the market is expected to expand from US$ 10.03 billion in 2024 to US$ 15.34 billion by 2030, at a compound annual growth rate (CAGR) of 7.3% between 2025 and 2030.

This growth is indicative of a broader movement toward intelligent, energy-efficient lighting systems as the nation rethinks how cities, businesses, and institutions illuminate their environments. From indoor retrofitting to large-scale outdoor upgrades, LED lighting is no longer just a cost-saving upgrade—it’s a foundational technology in the sustainable built environment.

The LED market’s upward trajectory is largely fueled by the increasing demand for sustainable and federally compliant lighting solutions across commercial, industrial, and municipal sectors. As businesses and institutions modernize, legacy lighting systems are being replaced by high-efficiency LEDs that not only reduce energy costs but also align with national infrastructure goals.

One of the key drivers behind this transformation is the Buy American, Build America Act (BABA)—a critical part of the Infrastructure Investment and Jobs Act (IIJA). BABA emphasizes the use of domestically manufactured products in federally funded projects, creating a strong incentive for organizations to source lighting solutions from U.S.-based manufacturers.

This regulation is not just about origin. It’s about accountability, traceability, and long-term national growth. LED lighting products that meet BABA guidelines help project owners qualify for funding, maintain compliance, and reduce project approval hurdles.

In parallel, the shift toward smart and connected lighting systems continues to gain momentum. Driven by both compliance and performance demands, these systems offer real-time energy monitoring, adaptive dimming, and automation—all of which support long-term ESG (Environmental, Social, Governance) goals and smarter infrastructure planning.

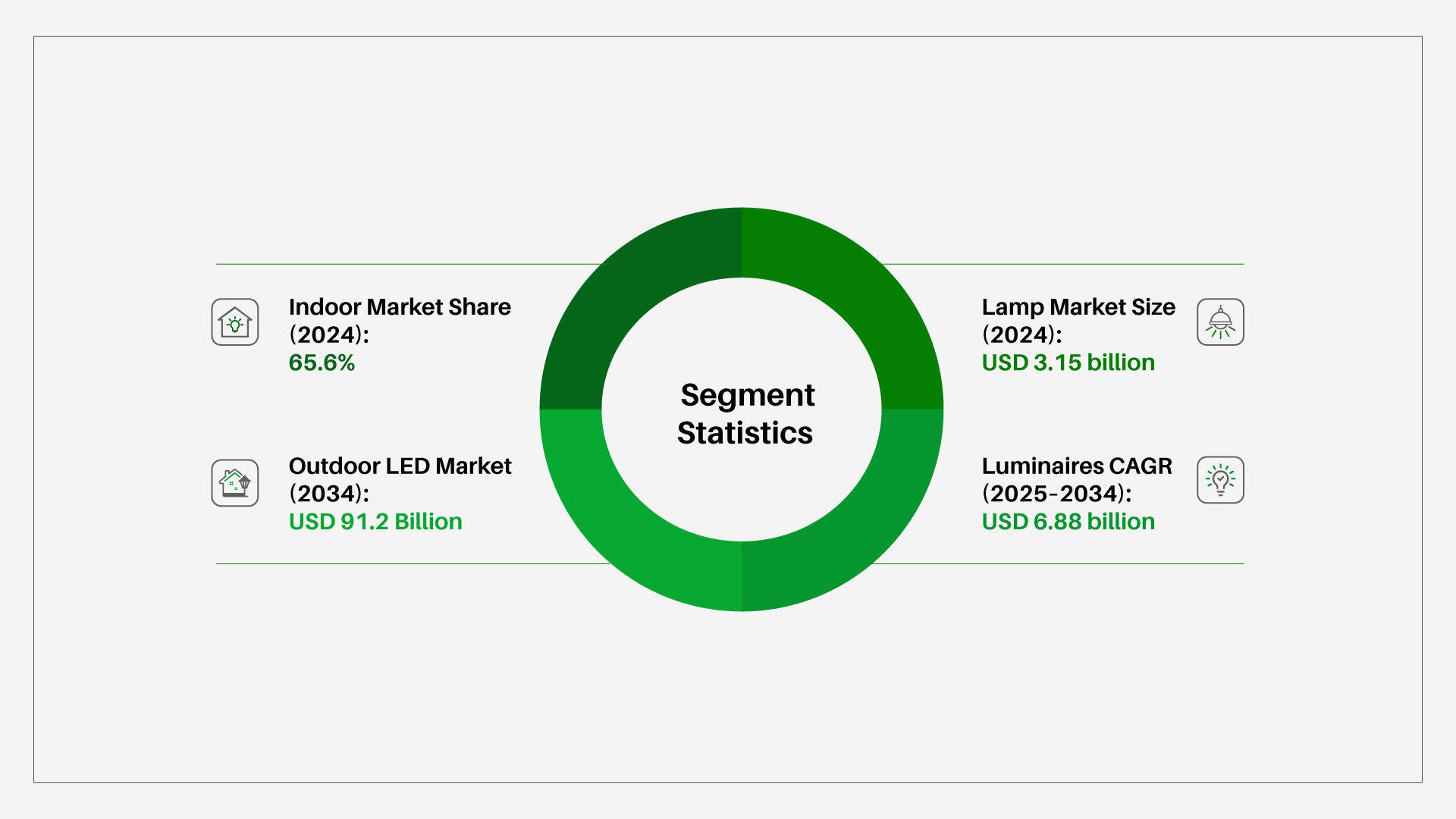

According to the latest data, the indoor lighting segment currently leads the market, accounting for 65.6% of the U.S. LED lighting share in 2024. This dominance stems from widespread retrofitting in commercial buildings, educational institutions, warehouses, and healthcare centers—sectors that continue to prioritize energy and cost efficiency.

According to the latest data, the indoor lighting segment currently leads the market, accounting for 65.6% of the U.S. LED lighting share in 2024. This dominance stems from widespread retrofitting in commercial buildings, educational institutions, warehouses, and healthcare centers—sectors that continue to prioritize energy and cost efficiency.

Meanwhile, the outdoor segment is projected to scale rapidly through 2034, driven by the emergence of smart cities, EV charging infrastructure, roadway upgrades, and public safety lighting initiatives. The outdoor LED market is expected to grow to an impressive US$ 91.2 billion by 2034, signaling major investment in urban transformation and intelligent infrastructure.

The lamp segment is valued at US$ 3.15 billion in 2024, while the luminaires category, which integrates smart features and digital connectivity, is forecasted to grow at a robust pace, reaching US$ 6.88 billion by 2034.

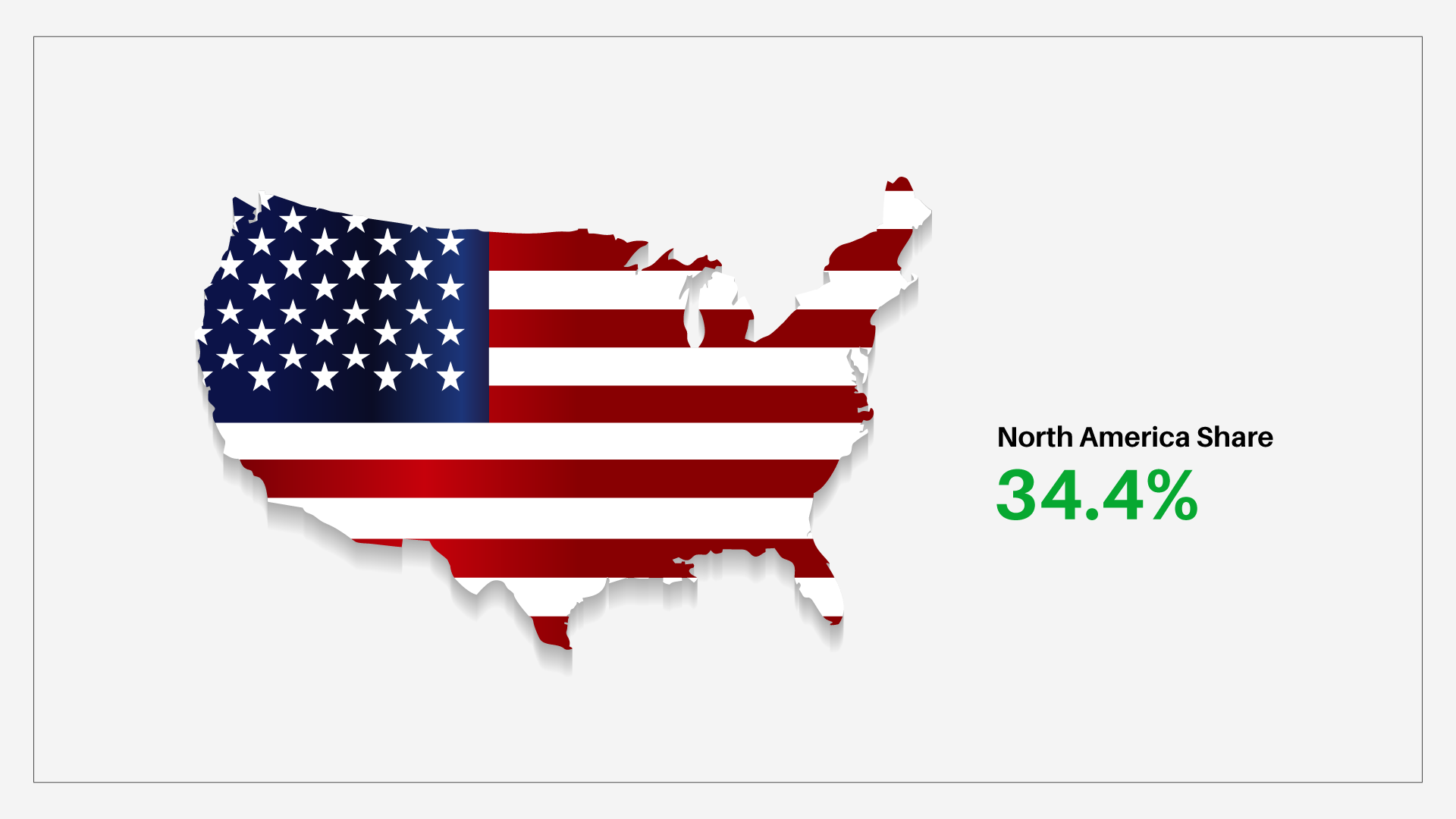

North America currently holds a 34.4% share of the global LED lighting market, with the U.S. leading the charge. This growth is driven by a confluence of government incentives, advanced infrastructure, and heightened environmental awareness.

North America currently holds a 34.4% share of the global LED lighting market, with the U.S. leading the charge. This growth is driven by a confluence of government incentives, advanced infrastructure, and heightened environmental awareness.

The region’s investments in smart cities, resilient public lighting systems, and digitally connected campuses further contribute to this dominance. Key growth states include California, Texas, New York, and Illinois, where sustainability regulations and technological readiness converge.

Additionally, federal funding through programs like the Infrastructure Investment and Jobs Act (IIJA) has unlocked new opportunities for cities to modernize transportation, utilities, and public spaces—all of which depend on modern, high-performance lighting.

With the increasing demand for local sourcing, faster delivery timelines, and tailored engineering, U.S.-based LED manufacturers play a critical role in the lighting value chain. Manufacturers offering domestically made, code-compliant, and customized solutions are well-positioned to support large-scale projects and retrofit initiatives.

This preference for local production is also a response to global supply chain volatility, making U.S. manufacturing a strategic asset rather than just a patriotic preference. For many stakeholders, proximity means confidence—confidence in delivery, performance, compliance, and long-term technical support.

From smart campuses to EV infrastructure, the momentum for LED lighting is undeniable. For facility managers, contractors, and developers, this is more than a market trend—it’s a competitive advantage. Partnering with a forward-thinking, U.S.-based manufacturer like IKIO LED Lighting ensures you're not only keeping up but leading the transition.

Need lighting solutions that meet U.S. codes, optimize energy usage, and elevate performance?